Where every move counts, and every decision can have a significant impact on your financial future. In the realm of trading, knowledge is not just power; it’s your key to success. Among the many tools available to traders, one stands out for its effectiveness in predicting price movements: Candlestick Patterns. In this extensive guide, we will delve into the intricacies of candlestick patterns.

Candlestick Patterns are a time-tested technique for analyzing price action in financial markets. These patterns provide valuable insights into market sentiment, helping traders make informed decisions. Let’s explore this fascinating subject in detail:

The Origin of Candlestick Patterns

Understanding the roots of Candlestick Patterns helps us appreciate their significance. These patterns trace their origins back to Japan in the 18th century, where they were initially used to analyze the price of rice contracts. The candlestick shape represents the open, close, high, and low prices within a specific time frame.

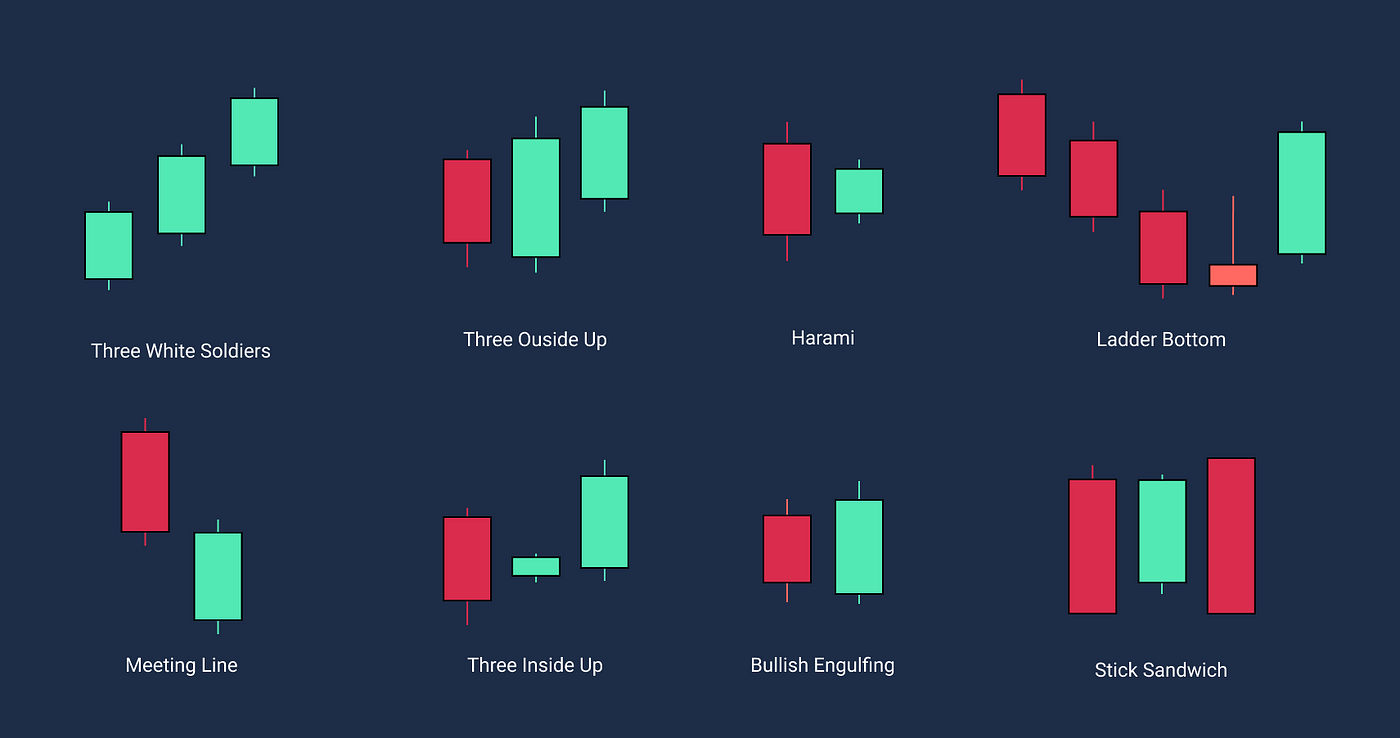

Types of Candlestick Patterns

1. Bullish Reversal Patterns

Candlestick Patterns: Reading Price Action for Better Trades often starts with bullish reversal patterns. These patterns indicate a potential shift from a bearish to a bullish trend. Some common bullish reversal patterns include:

- Hammer: This pattern resembles a hammer and suggests a potential bullish reversal when it appears after a downtrend.

- Bullish Engulfing: It occurs when a bullish candle fully engulfs the previous bearish candle, signifying a possible trend reversal.

- Piercing Line: This two-candle pattern consists of a bearish candle followed by a bullish candle, indicating a shift in momentum.

2. Bearish Reversal Patterns

On the flip side, bearish reversal patterns are crucial for identifying potential downturns. Some notable bearish reversal patterns include:

- Shooting Star: This candlestick has a small body with a long upper wick, signaling a potential bearish reversal.

- Bearish Engulfing: Similar to its bullish counterpart, this pattern suggests a potential shift from a bullish to a bearish trend.

- Dark Cloud Cover: Comprising two candles, this pattern warns of a potential trend reversal when a bearish candle follows a bullish one.

3. Continuation Patterns

Continuation patterns suggest that the existing trend is likely to persist. Recognizing these patterns can help traders stay on the right track. Some common continuation patterns include:

- Flag and Pennant: These patterns represent brief pauses in a trend before it continues in the same direction.

- Symmetrical Triangle: It signifies a period of consolidation before a potential breakout in either direction.

How to Read Candlestick Patterns

Mastering the art of reading Candlestick Patterns requires a keen eye and a deep understanding of market dynamics. Here are some key points to keep in mind:

- Body Size: The size of the candle’s body reflects the strength of the price movement. A long body indicates significant price action, while a short body suggests a lack of momentum.

- Wicks and Tails: Pay attention to the upper and lower wicks. Long upper wicks indicate selling pressure, while long lower wicks suggest buying pressure.

- Pattern Confirmation: It’s crucial to wait for confirmation before acting on a pattern. This can involve waiting for the next candle to confirm the reversal or continuation.

- Timeframes: Candlestick Patterns can vary in significance depending on the timeframe. Shorter timeframes may produce more frequent but less reliable signals, while longer timeframes offer more dependable insights.

- Combine with Other Indicators: Candlestick Patterns work best when used in conjunction with other technical and fundamental analysis tools. Combining these tools can enhance your trading strategy.

The Psychology Behind Candlestick Patterns

To truly excel in using Candlestick Patterns for trading, it’s essential to grasp the psychology behind them. Each pattern reflects the tug-of-war between bulls and bears in the market. Understanding the emotions and behavior of market participants can help you make better-informed decisions.

Common Mistakes to Avoid

While Candlestick Patterns can be powerful tools, they are not foolproof. Here are some common mistakes to avoid when using them for trading:

- Overtrading: Don’t jump into trades solely based on a single candlestick pattern. Always consider other factors.

- Ignoring Risk Management: Risk management is paramount in trading. Never risk more than you can afford to lose.

- Neglecting Fundamental Analysis: Candlestick Patterns should be used in conjunction with fundamental analysis to make well-rounded decisions.

- Impatience: Waiting for confirmation is crucial. Impulsive trading based on incomplete patterns can lead to losses.

- Lack of Education: Continuous learning is key in trading. Don’t assume you know everything about Candlestick Patterns after reading a single guide.

Real-World Applications

Let’s bring Candlestick Patterns into the real world with a practical example. Suppose you’re a stock trader analyzing a company’s stock price. You notice a “Bullish Engulfing” pattern after a period of decline. This could be a signal that the stock is about to reverse its downward trend. However, you wouldn’t rely solely on this pattern. You’d consider other factors like company news, industry trends, and broader market conditions before making a decision.

Expert Insights and Strategies

To truly harness the power of Candlestick Patterns, it’s invaluable to learn from experts in the field. Here are some insights and strategies from seasoned traders:

1. Combining Candlestick Patterns with Moving Averages

- Description: Many traders use moving averages in conjunction with Candlestick Patterns to confirm trends. For example, a “Golden Cross” (when a short-term moving average crosses above a long-term moving average) alongside a bullish Candlestick Pattern can provide a strong buy signal.

- Benefits: This strategy combines the precision of Candlestick Patterns with the reliability of moving averages.

2. Risk-Reward Ratio

- Description: Seasoned traders emphasize the importance of maintaining a favorable risk-reward ratio. This means that potential profits should outweigh potential losses in every trade.

- Benefits: Adhering to a strict risk-reward ratio helps protect your capital and prevents reckless trading.

3. Continuous Learning

- Description: The world of trading is dynamic, and markets evolve. Successful traders continuously educate themselves to stay ahead of the curve.

- Benefits: Staying informed about market developments and new trading strategies can give you an edge.

FAQs

Q: How do I get started with Candlestick Patterns? A: Begin by learning the basic patterns and their meanings. Practice identifying them on charts and start applying them in simulated trading before risking real capital.

Q: Are Candlestick Patterns suitable for all markets? A: Candlestick Patterns can be applied to various markets, including stocks, forex, commodities, and cryptocurrencies. However, it’s essential to adapt your strategies to each market’s unique characteristics.

Q: Can Candlestick Patterns predict market crashes? A: While Candlestick Patterns provide valuable insights, they are not crystal balls. They can signal potential reversals, but it’s crucial to consider other factors when predicting major market events.

Q: Is it possible to trade solely using Candlestick Patterns? A: While it’s possible to make trades based solely on Candlestick Patterns, it’s not recommended. Combining them with other analysis tools and strategies yields better results.

Q: How can I stay updated on Candlestick Patterns and trading trends? A: Follow reputable financial news sources, join trading communities, and consider enrolling in courses or webinars conducted by experienced traders.

Q: What is the most challenging aspect of mastering Candlestick Patterns? A: The most challenging part is developing the ability to recognize patterns quickly and accurately, as well as interpreting them in the context of the broader market.